Sensitivity Analysis

Create both goal-seek and risk mitigation sensitivity matrices across thousands of scenarios in seconds.

Shock appraiser inflation, contracted rents, sale value assumptions and future rents on any transaction.

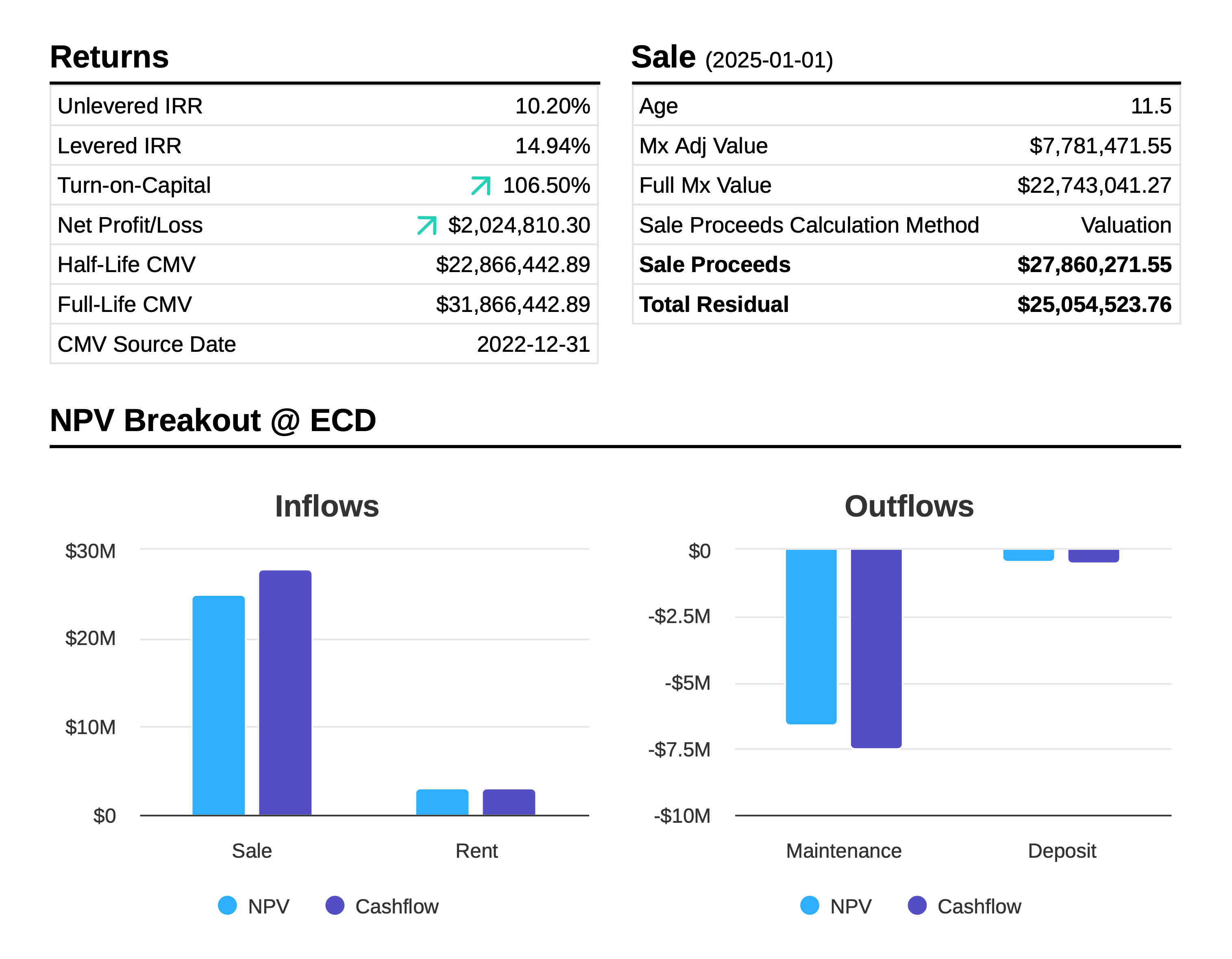

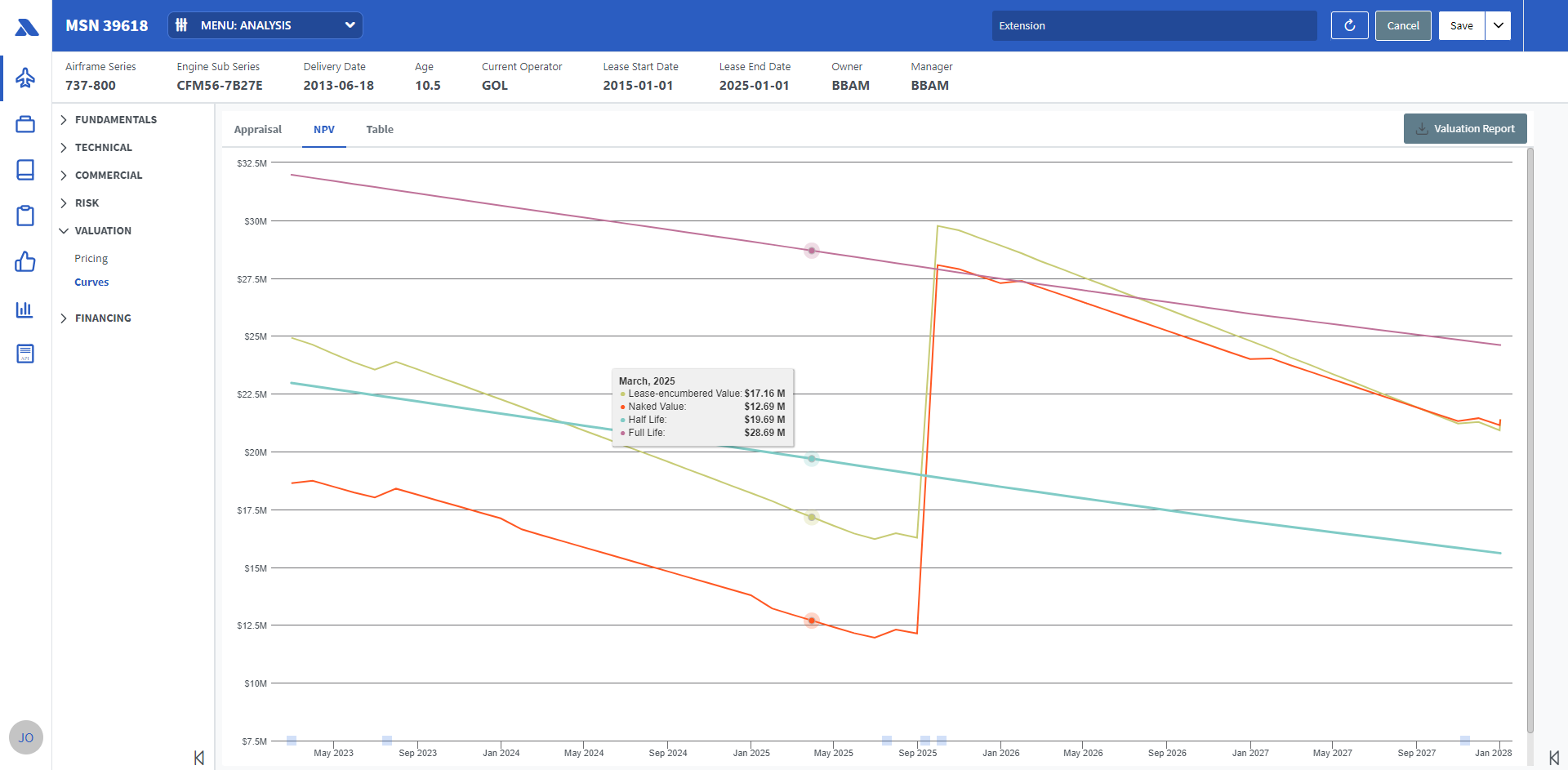

Lease Encumbered Valuation Outputs

Execute disposition strategies including hold to maturity vs. early exits through LEV vs. NBV portfolio management.

Set residual value assumptions based on appraised, maintenance adjusted, part-out, or lease encumbered value.

Appraiser & NBV Integrations

Import appraiser values and internal NBV automatically applying aggregation methodologies

Yield Sensitivities

Instantly adjust pricing as commercial negotiations progress and deal dynamics shift

SPA Adjustments

Model SPA adjusted purchase prices from ECD to TTD instantly

Fee & Expense Schedules

Upload investor or fund specific schedules to ensure accurate equity cashflow projections

Automated Investment Memos

Generate custom PDF investment memos across any transaction type, which are white labeled to each customer.

Add executive summary and recommendation commentary for each deal.